When it comes to protecting or helping caregivers, not all states are created equal. Federal laws, such as the Family and Medical Leave Act of 1993 and the Fair Labor Standards Act of 1938, create a minimum level of employee benefits and rights (such as the minimum wage and protected unpaid family leave). However, states are free to provide even more rights or benefits. Two such states are California and Minnesota, which will be highlighted in this blog post.

When it comes to protecting or helping caregivers, not all states are created equal. Federal laws, such as the Family and Medical Leave Act of 1993 and the Fair Labor Standards Act of 1938, create a minimum level of employee benefits and rights (such as the minimum wage and protected unpaid family leave). However, states are free to provide even more rights or benefits. Two such states are California and Minnesota, which will be highlighted in this blog post.

California

California provides some of the best benefits for caregivers and workers. Back in May, Niraj Chokshi wrote a detailed piece in the Washington Post titled “Best State in America: California, for Its Many Mom-Friendly Policies” that describes several advantages California workers (mothers, in particular) enjoy. Some of the points Chokshi made include the following:

California provides some of the best benefits for caregivers and workers. Back in May, Niraj Chokshi wrote a detailed piece in the Washington Post titled “Best State in America: California, for Its Many Mom-Friendly Policies” that describes several advantages California workers (mothers, in particular) enjoy. Some of the points Chokshi made include the following:

- California’s minimum wage is $9.00 per hour; the federal minimum wage is $7.25 per hour.

- The gender pay gap in California is one of the smallest in the nation at 16.1% (the national average is 21.7%). Only Washington, D.C., New York, Maryland, and Florida have lower gender wage gaps.

- California requires paid sick leave. Massachusetts and Connecticut are the only two other states that provide this benefit.

- Workers are entitled to up to six weeks of paid leave to take care of a loved one. New Jersey and Rhode Island are the only other states with this benefit.

- Medi-Cal, California’s Medicaid equivalent, covers lactation consultants and breast pumps.

- California requires employers to pay for a minimum amount of a day’s work, even if the workers are sent home early.

- California is the only state to require employers to pay extra compensation to employees who work split shifts.

Another benefit not mentioned in Niraj Chokshi’s article comes from the Family-School Partnership Act. This California law states that employers must allow a parent to take up to 40 hours each year to participate in their children’s school or childcare activities as long as the parent works for a business with 25 or more employees in one location.

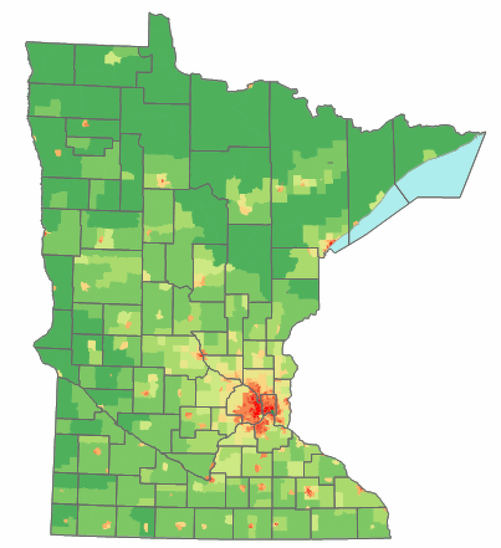

Minnesota

Like California, Minnesota’s minimum wage is $9.00 per hour for employees who work for employers with gross revenue of $500,000 or more per year. For smaller businesses, Minnesota’s minimum wage is the federal minimum wage of $7.25 per hour.

Like California, Minnesota’s minimum wage is $9.00 per hour for employees who work for employers with gross revenue of $500,000 or more per year. For smaller businesses, Minnesota’s minimum wage is the federal minimum wage of $7.25 per hour.

While Minnesota does not offer the same workplace benefits that California does, there are proposed and enacted programs to help needy families in Minnesota.

As of July 1 of this year, families in the Minnesota Family Investment Program have received an additional $110 a month to help offset housing costs. The Minnesota Family Investment Program provides job counseling and financial assistance to low-income families with children and low-income pregnant mothers.

Additionally, another $10 million will be allocated for the Child Care Assistance Program, which gives financial assistance to low-income families so that the parents can work or receive training and education that may lead to work.

Starting on October 1, 2015, families who are currently on public child support will get another $100 or $200 per month for each family, depending on the number of children.

Finally, Minnesota’s governor has proposed expanding Minnesota’s Child and Dependent Care Credit by providing $99.9 million in tax breaks to approximately 130,000 middle-class families. This extra funding would increase the maximum tax credit as well as increase the number of middle-class families eligible for the tax credit.

Summing It Up

California offers some of the best family and workplace benefits in the nation. These include the following:

- $9.00 per hour minimum wage;

- one of the smallest gender pay gaps in the nation;

- paid sick leave;

- up to six weeks of paid leave to take care of a loved one;

- state health-care coverage that includes access to lactation consultants and breast pumps;

- minimum pay for a full day’s work, even if a worker is sent home early; and

- extra pay to employees who work split shifts.

Minnesota also offers a higher than federally required minimum wage of $9.00 per hour, although only for businesses that have $500,000 or more in gross revenue.

Minnesota offers or has proposed the following benefits for low- and middle-income families:

- Participants of the Minnesota Family Investment Program are eligible for an additional $110 a month to help offset housing costs.

- Another $10 million will be allocated for the Child Care Assistance Program, which gives financial assistance to low-income families so that the parents can work or receive training and education that may lead to work.

- Starting on October 1, 2015, families who are currently on public child support will receive at least another $100 per month.

- Minnesota’s governor has proposed expanding Minnesota’s Child and Dependent Care Credit, providing $99.9 million in tax breaks to approximately 130,000 middle-class families.